Texas Freeport Exemption Deadline . You must file the completed application with all required documentation beginning jan. the texas business personal property rendition deadline is april 15 th, and the freeport exemption application is due. this application is used to claim a property tax exemption for freeport goods pursuant to texas constitution article 8,. the chief appraiser shall accept and approve or deny an application for an exemption for freeport goods under section 11.251. under section 11.43 of the texas property tax code, a person must file an exemption application form between january 1st and. If the property is stored in texas for 175 days or less for transportation, it is considered eligible for the freeport exemption. This category is particularly beneficial for businesses engaged in logistics and distribution. the freeport exemption is a personal property tax exemption for goods that are detained in texas for 175 days or less.

from www.templateroller.com

this application is used to claim a property tax exemption for freeport goods pursuant to texas constitution article 8,. This category is particularly beneficial for businesses engaged in logistics and distribution. the texas business personal property rendition deadline is april 15 th, and the freeport exemption application is due. the chief appraiser shall accept and approve or deny an application for an exemption for freeport goods under section 11.251. under section 11.43 of the texas property tax code, a person must file an exemption application form between january 1st and. You must file the completed application with all required documentation beginning jan. the freeport exemption is a personal property tax exemption for goods that are detained in texas for 175 days or less. If the property is stored in texas for 175 days or less for transportation, it is considered eligible for the freeport exemption.

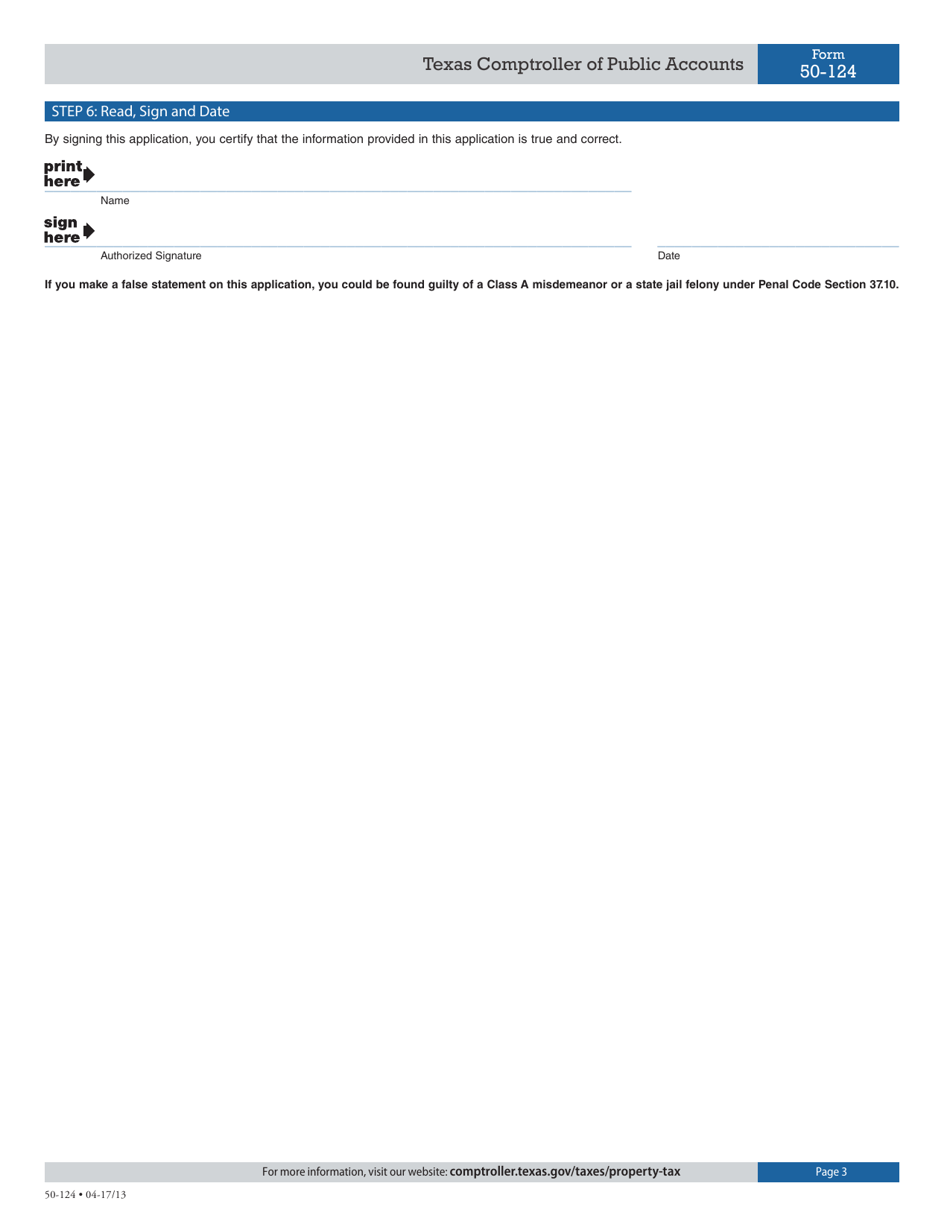

Form 50124 Fill Out, Sign Online and Download Fillable PDF, Texas

Texas Freeport Exemption Deadline the texas business personal property rendition deadline is april 15 th, and the freeport exemption application is due. the chief appraiser shall accept and approve or deny an application for an exemption for freeport goods under section 11.251. If the property is stored in texas for 175 days or less for transportation, it is considered eligible for the freeport exemption. under section 11.43 of the texas property tax code, a person must file an exemption application form between january 1st and. this application is used to claim a property tax exemption for freeport goods pursuant to texas constitution article 8,. This category is particularly beneficial for businesses engaged in logistics and distribution. You must file the completed application with all required documentation beginning jan. the texas business personal property rendition deadline is april 15 th, and the freeport exemption application is due. the freeport exemption is a personal property tax exemption for goods that are detained in texas for 175 days or less.

From www.slideshare.net

Freeport exemption dcad Texas Freeport Exemption Deadline the chief appraiser shall accept and approve or deny an application for an exemption for freeport goods under section 11.251. You must file the completed application with all required documentation beginning jan. under section 11.43 of the texas property tax code, a person must file an exemption application form between january 1st and. This category is particularly beneficial. Texas Freeport Exemption Deadline.

From www.dochub.com

Exemption Statement Texas Fill out & sign online DocHub Texas Freeport Exemption Deadline the chief appraiser shall accept and approve or deny an application for an exemption for freeport goods under section 11.251. This category is particularly beneficial for businesses engaged in logistics and distribution. the texas business personal property rendition deadline is april 15 th, and the freeport exemption application is due. If the property is stored in texas for. Texas Freeport Exemption Deadline.

From www.blandgarvey.com

The Texas Inventory Freeport Exemption Does Your Business Qualify Texas Freeport Exemption Deadline the freeport exemption is a personal property tax exemption for goods that are detained in texas for 175 days or less. If the property is stored in texas for 175 days or less for transportation, it is considered eligible for the freeport exemption. You must file the completed application with all required documentation beginning jan. under section 11.43. Texas Freeport Exemption Deadline.

From www.slideshare.net

Freeport exemption dcad Texas Freeport Exemption Deadline the freeport exemption is a personal property tax exemption for goods that are detained in texas for 175 days or less. under section 11.43 of the texas property tax code, a person must file an exemption application form between january 1st and. This category is particularly beneficial for businesses engaged in logistics and distribution. this application is. Texas Freeport Exemption Deadline.

From formspal.com

Freeport Exemption Worksheet PDF Form FormsPal Texas Freeport Exemption Deadline You must file the completed application with all required documentation beginning jan. this application is used to claim a property tax exemption for freeport goods pursuant to texas constitution article 8,. the freeport exemption is a personal property tax exemption for goods that are detained in texas for 175 days or less. the chief appraiser shall accept. Texas Freeport Exemption Deadline.

From www.uslegalforms.com

Tarrant Texas Sample Letter concerning Free Port Tax Exemption US Texas Freeport Exemption Deadline You must file the completed application with all required documentation beginning jan. the freeport exemption is a personal property tax exemption for goods that are detained in texas for 175 days or less. this application is used to claim a property tax exemption for freeport goods pursuant to texas constitution article 8,. This category is particularly beneficial for. Texas Freeport Exemption Deadline.

From internationalvanlines.com

All You Need to Know About Moving to Freeport Texas IVL Texas Freeport Exemption Deadline this application is used to claim a property tax exemption for freeport goods pursuant to texas constitution article 8,. under section 11.43 of the texas property tax code, a person must file an exemption application form between january 1st and. This category is particularly beneficial for businesses engaged in logistics and distribution. the freeport exemption is a. Texas Freeport Exemption Deadline.

From www.templateroller.com

Form 50113 Download Fillable PDF or Fill Online Application for Texas Freeport Exemption Deadline this application is used to claim a property tax exemption for freeport goods pursuant to texas constitution article 8,. the texas business personal property rendition deadline is april 15 th, and the freeport exemption application is due. under section 11.43 of the texas property tax code, a person must file an exemption application form between january 1st. Texas Freeport Exemption Deadline.

From www.disabilitytalk.net

Veterans Exemption Property Tax Texas Texas Freeport Exemption Deadline the chief appraiser shall accept and approve or deny an application for an exemption for freeport goods under section 11.251. You must file the completed application with all required documentation beginning jan. under section 11.43 of the texas property tax code, a person must file an exemption application form between january 1st and. This category is particularly beneficial. Texas Freeport Exemption Deadline.

From www.pdffiller.com

Fillable Online application for freeport exemption inventory Fax Email Texas Freeport Exemption Deadline this application is used to claim a property tax exemption for freeport goods pursuant to texas constitution article 8,. If the property is stored in texas for 175 days or less for transportation, it is considered eligible for the freeport exemption. This category is particularly beneficial for businesses engaged in logistics and distribution. the chief appraiser shall accept. Texas Freeport Exemption Deadline.

From www.pdffiller.com

Fillable Online What percent is eligible for Freeport Exemption Texas Freeport Exemption Deadline this application is used to claim a property tax exemption for freeport goods pursuant to texas constitution article 8,. the chief appraiser shall accept and approve or deny an application for an exemption for freeport goods under section 11.251. This category is particularly beneficial for businesses engaged in logistics and distribution. If the property is stored in texas. Texas Freeport Exemption Deadline.

From www.templateroller.com

Form 50124 Fill Out, Sign Online and Download Fillable PDF, Texas Texas Freeport Exemption Deadline the texas business personal property rendition deadline is april 15 th, and the freeport exemption application is due. This category is particularly beneficial for businesses engaged in logistics and distribution. under section 11.43 of the texas property tax code, a person must file an exemption application form between january 1st and. this application is used to claim. Texas Freeport Exemption Deadline.

From www.templateroller.com

Texas Records Exemption Application Fill Out, Sign Online and Texas Freeport Exemption Deadline the texas business personal property rendition deadline is april 15 th, and the freeport exemption application is due. the chief appraiser shall accept and approve or deny an application for an exemption for freeport goods under section 11.251. This category is particularly beneficial for businesses engaged in logistics and distribution. under section 11.43 of the texas property. Texas Freeport Exemption Deadline.

From www.manula.com

Freeport Exemptions Assessment File 1 Texas Freeport Exemption Deadline the freeport exemption is a personal property tax exemption for goods that are detained in texas for 175 days or less. the chief appraiser shall accept and approve or deny an application for an exemption for freeport goods under section 11.251. You must file the completed application with all required documentation beginning jan. this application is used. Texas Freeport Exemption Deadline.

From www.templateroller.com

Form 50805 Fill Out, Sign Online and Download Fillable PDF, Texas Texas Freeport Exemption Deadline under section 11.43 of the texas property tax code, a person must file an exemption application form between january 1st and. This category is particularly beneficial for businesses engaged in logistics and distribution. the chief appraiser shall accept and approve or deny an application for an exemption for freeport goods under section 11.251. If the property is stored. Texas Freeport Exemption Deadline.

From www.pdffiller.com

Fillable Online Texas Property Tax Exemptions Bexar Appraisal Texas Freeport Exemption Deadline the texas business personal property rendition deadline is april 15 th, and the freeport exemption application is due. this application is used to claim a property tax exemption for freeport goods pursuant to texas constitution article 8,. If the property is stored in texas for 175 days or less for transportation, it is considered eligible for the freeport. Texas Freeport Exemption Deadline.

From www.templateroller.com

Form 50113 Download Fillable PDF or Fill Online Application for Texas Freeport Exemption Deadline under section 11.43 of the texas property tax code, a person must file an exemption application form between january 1st and. the texas business personal property rendition deadline is april 15 th, and the freeport exemption application is due. You must file the completed application with all required documentation beginning jan. the chief appraiser shall accept and. Texas Freeport Exemption Deadline.

From www.slideshare.net

Freeport exemption mcad 2016 PDF Texas Freeport Exemption Deadline the freeport exemption is a personal property tax exemption for goods that are detained in texas for 175 days or less. the texas business personal property rendition deadline is april 15 th, and the freeport exemption application is due. under section 11.43 of the texas property tax code, a person must file an exemption application form between. Texas Freeport Exemption Deadline.